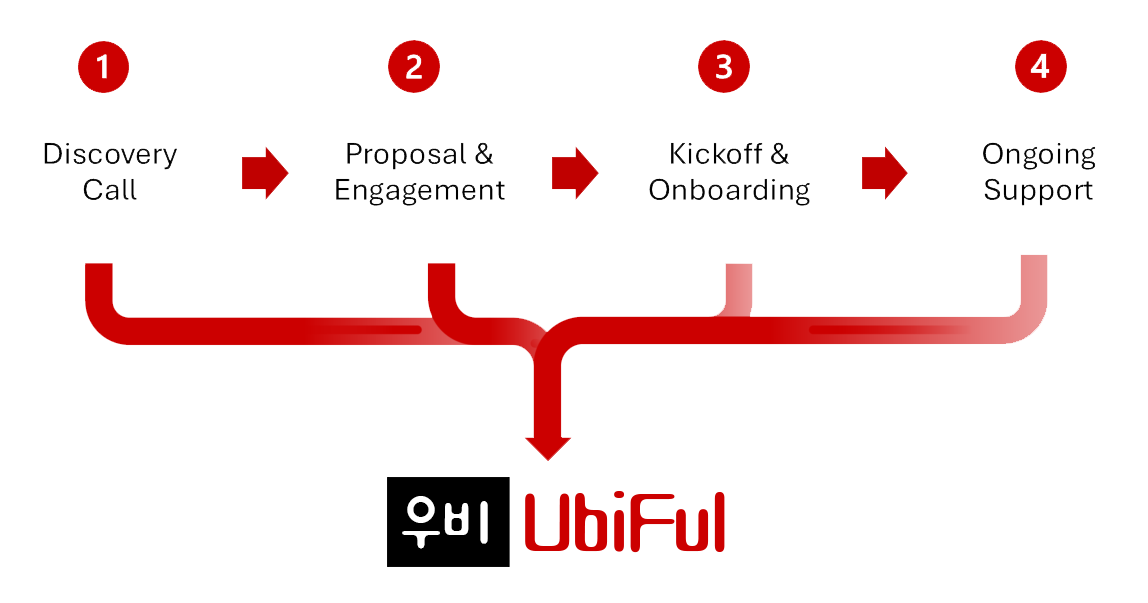

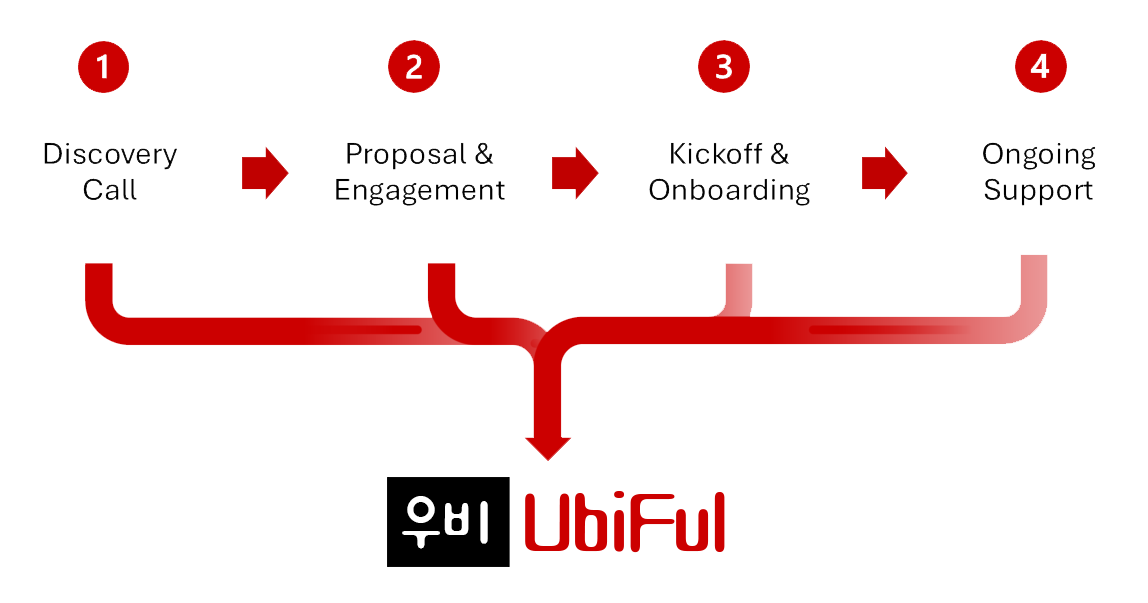

How We Work

We start by meeting with business founders and key stakeholders to understand your company's goals, challenges, and opportunities. This complimentary service allows us to conduct a high-level assessment of your business needs, industry positioning, and areas for improvement. It's all about getting to know you and your vision.

Once we have a clear understanding of your business, we dive into the specifics with in-depth discovery consultations. We evaluate the effectiveness of your current pitch deck, conduct a detailed business model analysis, and review your financial health. Our goal is to assess your strengths, identify gaps, and qualify your opportunities for growth and scalability.

With the information from our initial assessment and due diligence phase, we create actionable, customized strategies that deliver results. Our consulting focuses on:

Every business is unique, so we tailor our strategies to meet your specific needs.

Our approach is grounded in data and best practices, ensuring that every decision is backed by solid evidence.

We're not just consultants; we're partners invested in your ongoing success.

Our team brings years of industry experience and a track record of success in helping businesses grow and scale.

Entering daily financial transactions (sales, purchases, receipts, and payments).

Comparing bank statements with internal records to ensure consistency. Identifying discrepancies and resolving them.

Tracking bills and making sure vendors are paid on time. Organizing and maintaining records of due payments.

Issuing and tracking customer invoices. Monitoring outstanding receivables and following up on late payments.

Creating and updating a structured list of all accounts used in financial transactions.

Keeping a record of all financial activity in the business. Categorizing and summarizing data correctly.

Entering payroll data (Note: This does not include payroll tax filing unless specified).

Profit & Loss (Income), Balance Sheet, and Cash Flow Summary